There is a direct relationship between business success and revenue. A business is considered successful when it generates consistent revenue over the accounting periods. One of the main factors contributing to business success is how well it manages its inventory. Inventory comprises a major chunk, 45% to 90%, of any business’s budget.

But still, up to 43% of small businesses do not monitor their inventory, making it one of the top 10 reasons why most startups fail. Because at the end of the accounting period, they are either left with too much inventory, or their inventory finishes even before the accounting period closes. For better management of your inventory and to plan which items are generating more profit margins and which are sitting in the warehouse, you first need to calculate your ending inventory. Ending inventory is the portion of sellable inventory that a business has left after the closing of an accounting period, directly impacting the business’s overall profits and health.

In this blog, we will discuss how to calculate ending inventory to ensure a minimum inventory at the end of the closing period.

What is ending inventory?

A portion of a business has inventory left at the end of the closing/accounting period is known as ending inventory.

You must be wondering why we should manage the ending inventory when we are already managing safety stocks and everything else?

Well….

According to research, the average business holds USD 142,000 worth of extra inventory, more than they actually need to perform smooth operations. This leads to overstocking, which may result in increased ending inventory. Research also shows that up to 42% of small businesses struggle with overstocking, which increases their holding costs by 20-30%. When you only focus on stockouts and try to be cautious about not running out of stock, you might end up overstocking, which can seriously impact your business. With capital tied up in sitting inventory, you cannot manage proper cash flow, leading to poor operations, low restocking, and a reduced budget for marketing activities. This leaves you with more inventory but fewer sales.

Is ending inventory the same as closing inventory?

Yes, both terms have the same meaning. Ending inventory is used interchangeably with closing inventory. Both represent the portion of inventory left at the end of the accounting period.

How to calculate ending inventory?

You can easily calculate the ending inventory using the most basic formula.

Ending Inventory = Beginning Inventory + Net Purchases – Cost of Goods Sold (COGS)

Where:

- Beginning inventory is the value of inventory at the start of the period (equal to the previous period’s ending inventory)

- Net purchases represent inventory acquisitions during the period

- COGS is the cost of items sold during the period

You do not need fancy tools and software to calculate the ending inventory. The easiest way is to physically count the inventory, keep the records straight in spreadsheets, and calculate it at the end of the closing period.

But if you are managing a large inventory with multiple goods, using reliable inventory management software like SeeBiz inventory management will be a good idea. It will reduce manual errors and allow you to do weeks of work in a few hours or minutes.

How can you calculate ending inventory using different methods?

1- How to calculate ending inventory using FIFO

FIFO (First-in, First-out) works in this way: the first items purchased will also be the first ones sold. The easiest way to understand this is by considering a grocery store and how milk coolers are filled there. The old inventory comes in front, and the latest goes to the back. That’s a FIFO method where your ending inventory will be your latest inventory.

To calculate ending inventory using FIFO:

- List your beginning inventory

- Record all new purchases made during the period

- Calculate COGS based on the oldest inventory items

- Subtract COGS from the sum of the beginning inventory plus new purchases

In FIFO, the ending cost may seem high because the ending inventory comprises the latest inventory, and the cost associated with the newest batches may be higher than the older ones. Therefore, it’s wise to keep a window for cost adjustment to manage the balance sheet properly.

To understand this, let’s take a look at another simple example;

You purchased 10 items for $10 each. Next month, you will purchase the same 10 items, but now the price of each is $12. Therefore, when calculating the ending inventory, the cost of leftovers may seem high because of the new rates.

To learn more about how FIFO works in inventory management, read this.

2- How to calculate ending inventory using LIFO

LIFO (Last-in, first-out) works like this: the inventory purchased last will be sold first. In LIFO, your ending inventory will be your old inventory.

To calculate ending inventory using LIFO:

- Start with your beginning inventory

- Add all purchases made during the period

- When calculating sold items, assume the newest inventory was sold first

- The remaining items (older inventory) constitute your ending inventory

In LIFO, the value of the ending inventory may seem less, but keep in mind that it’s your old inventory, and the cost might be less due to the different purchase prices associated with older batches. When calculating the ending cost using the LIFO method, keep the window for cost adjustment.

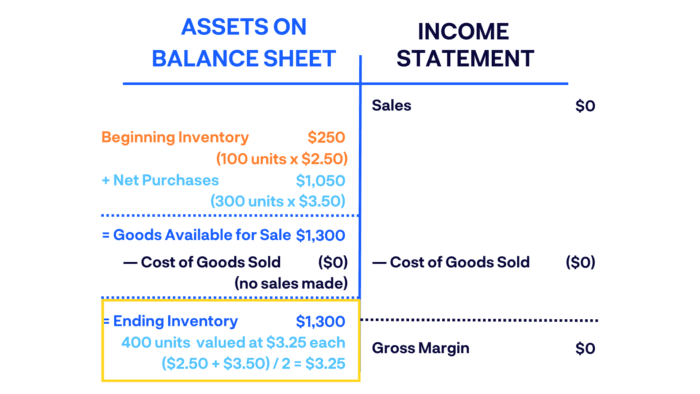

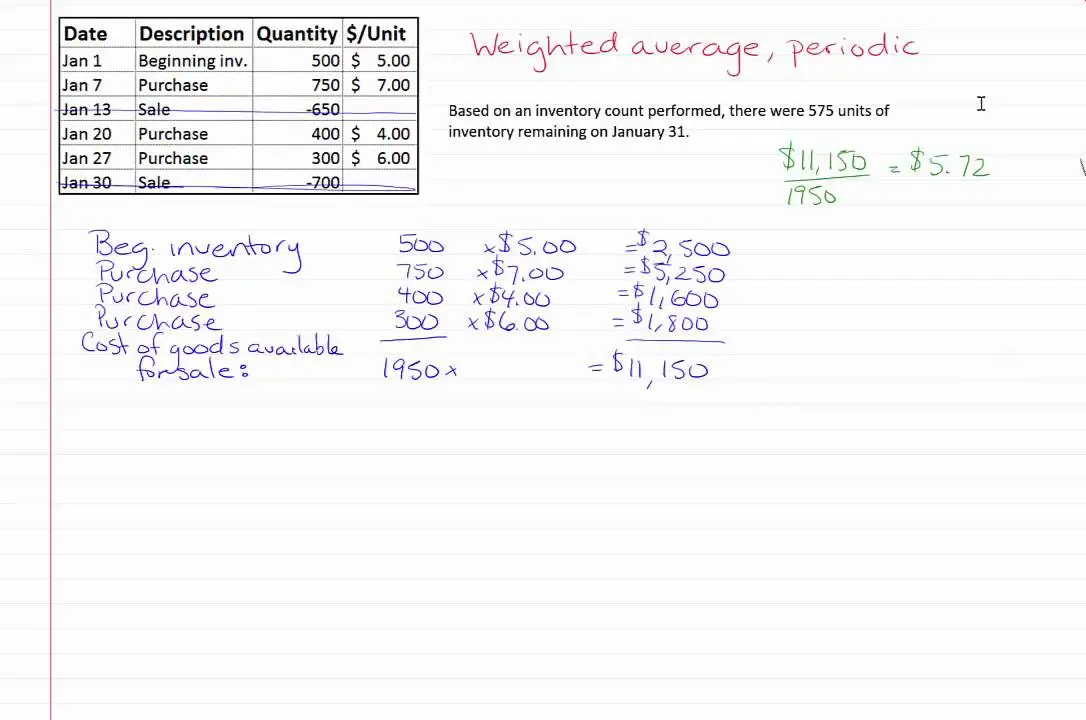

3- How to calculate ending inventory using weighted average

This method calculates the average cost for all similar items in inventory, regardless of purchase date. In the weighted average method, we apply specific weights to the individual items based on their quantity and then calculate the average cost. For example, we have 10 mugs in the inventory, purchased at different times at different costs. Rather than applying different costs to each mug, we will add the total price of all mugs and then calculate the average cost of each mug to use in the balance sheet.

To calculate ending inventory using the average cost method, first;

- Find out the total number of unsold units available in inventory

- Now, calculate the value of the unsold stock

- Lastly, calculate the weighted average cost of each unit available in your unsold inventory.

Weighted average cost per unit = Total cost of goods available for sale / Total number of units available

- Then multiply the average weighted cost by the units available (unsold in inventory) to find the ending inventory.

To understand this further, you can see the video below, along with an example:

4- Is the average cost method the same as the weighted average?

The average cost method and weighted average are basically the same, with slight variations. In the average cost method, we can calculate the average cost of all items available in unsold inventory, while in the weighted average method, we apply specific weights to individual units and then calculate the average cost of all items.

Both methods calculate an average unit cost by taking:

- The total cost of goods available for sale,

- Dividing it by the total number of units available for sale.

Weighted Average Cost per Unit= Cost of Goods Available for Sale / Units Available for Sale

For example:

- 100 units bought for $10 each = $1,000

- 200 units bought for $15 each = $3,000

- Total = 300 units for $4,000

- Weighted average = $4,000 ÷ 300 = $13.33 per unit

All units are valued at $13.33, whether sold or left in ending inventory.

5- How to calculate ending inventory using the absorption costing method

In absorption costing or full costing, we add all costs associated with production into the inventory valuation, including direct materials, direct labor, and variable and fixed manufacturing overhead.

For example;

To calculate ending inventory using absorption costing:

- Calculate the cost per unit: Total production cost ÷ Number of units produced

- Calculate ending inventory value: Cost per unit × Number of units in ending inventory

Let’s say a company manufactures chairs.

- Direct materials cost per chair: $20

- Direct labor cost per chair: $15

- Variable manufacturing overhead per chair: $5

- Fixed manufacturing overhead (total for the factory): $10,000

- Units produced during the month: 1,000 chairs

Step 1: Calculate fixed overhead per unit

Fixed overhead = Total fixed costs ÷ Units produced

= $10,000 ÷ 1,000

= $10 per chair

Step 2: Add up all costs to find the absorption cost per unit

Direct materials: $20

Direct labor: $15

Variable overhead: $5

Fixed overhead: $10

Total cost per chair = $50 (Absorption Cost)

Step 3: How absorption costing affects ending inventory

If the company has 200 unsold chairs at the end of the month:

Ending inventory value = 200 × $50

= $10,000

This $10,000 will be shown as an ending inventory on the balance sheet.

How to calculate ending inventory without cost of goods sold

If you don’t have COGS, you can still calculate ending inventory using this simple formula: Ending Inventory = Beginning Inventory + Net Purchases – Sales.

Yes, sales are not COGS, but you can still calculate ending inventory with this. There are two methods that you can use to calculate your ending inventory without the cost of goods sold available;

| Method | Data needed | Formula/Process |

| Gross Profit Method | Gross profit, sales, purchases, and opening inventory | Ending Inventory = Beginning Inventory + Purchases – (Sales – Gross Profit) |

| Retail Inventory Method | Retail values, cost-to-retail ratio | Ending Inventory (Cost) = (Begin Inv. + Purchases – Sales) × Cost-to-Retail Ratio |

Which ending inventory calculation method should you use?

Based on your business type or inventory management model, you can choose which method will be best for accurately calculating ending inventory.

FIFO (First-In, First-Out) works best when prices are rising. It sells older, cheaper items first, which makes the ending inventory appear higher. This method can make your balance sheet look stronger.

LIFO (Last-In, First-Out) is preferable when prices are increasing. It sells the newer, more expensive items first, lowering taxable income but making the ending inventory appear lower.

Weighted Average Cost is useful when inventory prices change frequently, as it balances out these fluctuations over time.

Absorption Costing, required by GAAP for external financial reports, includes all manufacturing costs, both variable and fixed, providing a complete view of costs.

If you’re still unsure which method to choose, I suggest you start with FIFO. It’s often the safest starting point for most wholesalers and other businesses.

| Method | Best For | Effect on Ending Inventory |

| FIFO | Rising prices, perishables | Higher ending inventory value |

| LIFO | Inflation, reducing taxes | Lower ending inventory value |

| Weighted Average | Fluctuating prices, bulk items | Mid-range ending inventory |

| Absorption Costing | Full-cost accounting (GAAP rules) | Includes fixed overhead costs |

Practices you should follow if you want to calculate an error-free ending inventory

1- Regular counts

Conduct regular counts to match your physical ending inventory to the one you put in the balance sheet.

2- Right Method

Depending on your industry and goods, choose the method that is best suited. If you deal in perishable goods, FIFO might work for you, or LIFO might be a good choice if you deal in manufacturing.

3- Using an inventory management software

To keep your count free from any manual error, consider using inventory management software. That makes your counts easy, fast, and free from possible errors. But yes, don’t get lazy and keep up with your physical counts to match the data.

4- Consistency

Be consistent while keeping track of your ending inventory. If you are just focusing on calculating safety stock and COGS, you might get dizzy when you find out the value of the ending inventory you kept at the end of the closing period. You don’t want this, right? To make sure you have a calculated amount of inventory left, and not more than the value of units sold, be consistent and conduct counts regularly.

5- Keeping account of discrepancies or damage

While managing your ending inventory, also keep track of damaged or lost items. Most of the time, we ignore them, but in the end, they also have value. Write that value down and get a realistic estimate of your profits.

Conclusion

Managing ending inventory is also a part of proper inventory management. If you ignore even a single aspect, like not calculating ending inventory, you will see that by the end you won’t be able to determine how much profit you made. Is your business generating any revenue, or are you just wasting your capital with the same value of inventory sitting at the end of each accounting period?

Knowing how to calculate ending inventory can help you plan your next inventory batch, identify how much or which product is needed, and determine which stock is dead and should be eliminated.

So if you haven’t started yet, begin at the end of this closing/accounting period.

FAQs

What is ending inventory?

A portion of a business has inventory left at the end of the closing/accounting period is known as ending inventory.

How to calculate ending inventory without cost of goods sold

If you don’t have COGS, you can still calculate ending inventory using this simple formula: Ending Inventory = Beginning Inventory + Net Purchases – Sales.

Yes, sales are not COGS, but with this, you can find the ending inventory.

How to calculate ending inventory?

You can easily calculate the ending inventory using the most basic formula.

Ending Inventory = Beginning Inventory + Net Purchases – Cost of Goods Sold (COGS)

What is the formula for calculating ending inventory?

Using this general formula, you can calculate ending inventory

Ending Inventory = Beginning Inventory + Net Purchases – Cost of Goods Sold (COGS)

What is an example of ending inventory?

Suppose your beginning inventory is worth $10,000. You purchased new products worth $3000. Your total inventory value is $13000. You sold units worth $8000. Your sellable ending inventory left at the end of the accounting period is worth $5000.