A retail price is the price at which you sell your product in the market. It is calculated as; (Cost of the good + Markup/profit).

A wrong retail price can kill your business before it even gets started. Why? Because for a company to grow, it needs a system where operational expenses, marketing, inventory, and all other business costs are covered by the revenue the business generates. This means the profit margin or markup you set over your retail price must consider market trends, customer psychology, brand perception, product inventory, and business operations.

In this blog, we will learn how based on different pricing models and using various formulas, we can calculate the RRP or recommended retail price of any product.

What is RRP (Recommended Retail Price)?

The price that the manufacturer suggests a retailer sell their products for is known as a recommended retail price or RRP.

As its name suggests, it’s just a recommendation, not an obligation. A retailer can always set a different price based on the factor we discussed earlier.

How RRP is different from MSRP, SRP, and MAP

RRP goes with a lot of other terms.

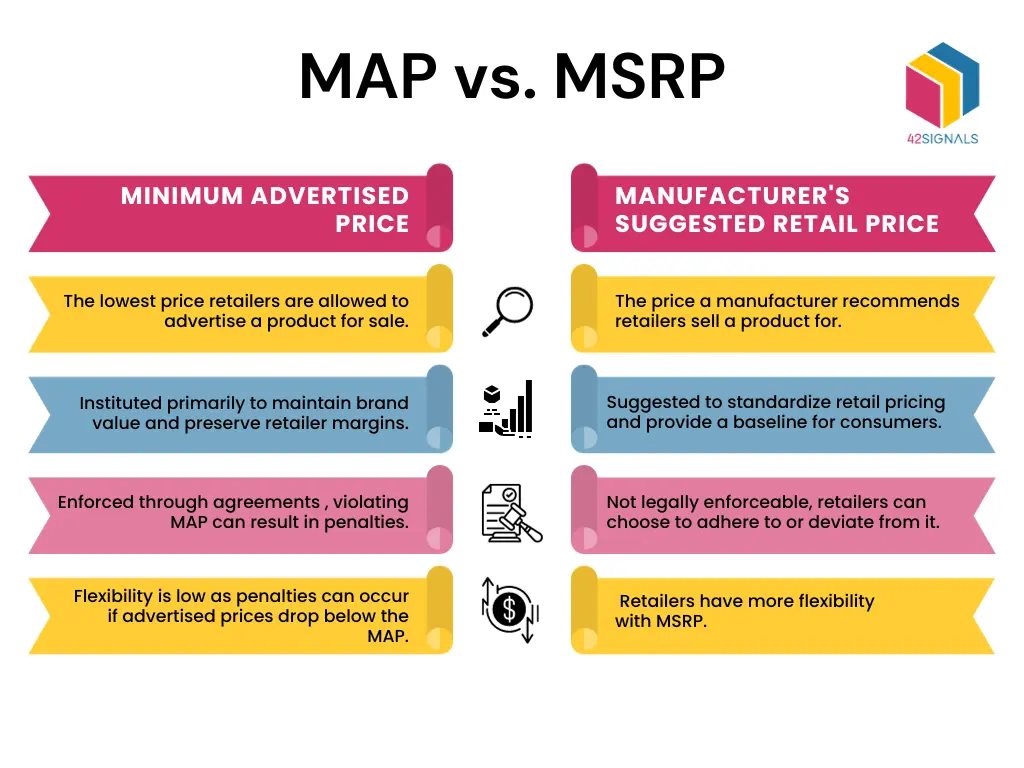

One is MSRP or the manufacturer’s suggested retail price. RRP and MSRP have the same meaning, but some people prefer to say MSRP.

Another one is SRP, or suggested retail price. It is the same as RRP, but can be said either way.

MAP, on the other hand, is the Minimum Advertising Price. It’s the minimum price that a retailer can publicly advertise a product for. It is also recommended by the manufacturer to prevent price erosion and maintain the brand’s perceived value.

Why is RRP important?

RRP is important for a brand when publicly selling products in a competitive market with multiple retailers trying to get their part of the profit. With a recommended price, a business can contribute to global uniformity and branding.

For example:

A hat is sold by different retailers at varying price points, based on the perceived value of the brand or retailer.

However, based on the RRP, no retailer can lower the price below the recommended price to attract more customers. This way, RRP sets a level playing field for all the retailers to compete with a set benchmark.

Basic formulas to calculate RRP

Method 1: Cost-Plus Pricing

Cost-plus pricing is often the most simple way for a business (whether manufacturer or retailer) to find out a profitable selling price. This method involves calculating all costs associated with a product and then adding a desired profit margin.

The basic formula is:

Selling Price = Cost Price + (Cost Price × Desired Profit Margin)

Or: RRP = Total Cost + Overheads + Desired Profit Margin

Many businesses, especially small retailers, often forget to include all their costs when setting prices. They might miss expenses like payment processing fees, return costs, marketing, or even the owner’s salary. This can lead to setting prices that seem profitable but aren’t after all costs are included. A small markup, like 30%, might look good, but if extra costs aren’t considered, profits can be much lower or even negative. If businesses only focus on undercutting competitors without understanding their actual costs, they can end up with unsustainable prices. To succeed and stay competitive, businesses need to carefully calculate all costs. This helps set realistic prices and avoids outdated strategies that can stall growth.

Here is a breakdown of costs to consider for an accurate RRP calculation:

| Cost Category | Examples |

| Direct Costs (Cost of Goods Sold – COGS) | Raw Materials |

Example: Consider a business that produces handcrafted leather wallets.

Total Costs

-

- Materials (leather, thread, hardware): $15

- Direct Labor (time spent making each wallet): $20

- Packaging: $2

- Shipping (to the warehouse): $3

- Subtotal Direct Costs: $40

- Monthly Overheads (rent, marketing, software, etc.): $500

- If 100 wallets are produced a month, Overhead per unit = $500 / 100 = $5

- Total Cost per Wallet = $40 (Direct) + $5 (Overhead) = $45

Desired Profit Margin: The business aims for a 30% profit margin.

Calculation

Selling Price = $45 + ($45 × 0.30)

Selling Price = $45 + $13.50

Selling Price = $58.50 Thus, the RRP using the cost-plus method would be $58.50.

Method 2: Manufacturer’s RRP Formula (When Provided)

If a business is a retailer, the manufacturer might give a formula to find the retail price, including their profit margin and the retailer’s margin. Retailers usually don’t do this calculation themselves, but it’s helpful to understand if the supplier provides it.

The formula provided in some cases is:

RRP = (Producer Margin % x Unit Cost x Quantity per Package) + Retailer Product Margin

Example: Imagine a gadget manufacturer sets the following:

- Producer Margin: 20%

- Unit Cost (to manufacturer): $5

- Quantity per Package: 1 unit

- Retailer Product Margin: 15% (This is often a percentage of the final RRP or a fixed dollar amount the retailer expects to make). For simplicity and to match the provided example, we’ll interpret “Retailer Product Margin” as a percentage of the unit cost.

Calculation:

- Producer’s portion of the RRP: (0.20 * $5 * 1) = $1.00

- Retailer’s portion of the RRP: (0.15 * $5) = $0.75

- RRP = Unit Cost + Producer’s Portion + Retailer’s Portion

- RRP = $5 + $1.00 + $0.75 = $6.75

It is important to note that in more practical scenarios, the retailer’s margin is typically applied to the wholesale price they pay, or it is a target percentage of the final retail price. The formula presented in the source material is a simplified, manufacturer-centric view.

Method 3: Keystone Pricing (Retail Rule of Thumb)

Keystone pricing is a common, simple strategy where the retail price is set at double the wholesale cost.

The formula is: Retail Price = Wholesale Price × 2

When to apply it and when not to

Pros:

This method is incredibly easy to calculate and ensures a consistent 50% gross margin on the selling price. It is often a reliable strategy for products with slow inventory turnover, high handling and shipping costs, or those that are exclusive.

Cons:

Keystone pricing might be too high for highly competitive items, leading to lost sales. Or, it could be too low for unique, high-value products where customers would be willing to pay more, again leaving potential profit on the table. This method doesn’t include all costs or clear market demand.

Step-by-Step RRP Calculation

Step 1: Calculate your total unit cost

Divide total overhead costs by the number of products sold to calculate the cost per product. Include all the direct and indirect costs:

- Raw materials

- Manufacturing labor

- Packaging

- Shipping to the warehouse

- Overhead allocation (rent, utilities, administrative costs)

Step 2: Determine Your Desired Profit Margin

Decide on your target profit percentage. Industry benchmarks (e.g., 8-12% for retail, 20-40% for software) and competitor margin research can help guide this, balancing profit goals with market competitiveness.

Step 3: Factor in Retailer Markup

If you’re a manufacturer, consider the typical retailer markup (often 25-100% depending on industry/product). When negotiating, be transparent about market pricing and open to flexible terms. Regional variations can also influence expected markups.

Step 4: Add VAT/Sales Tax Considerations

In the US, sales tax is added at the point of sale and varies significantly by state and local jurisdiction. It’s a percentage of the net sales price. For example, Colorado’s state sales tax is 2.9%, but local taxes can raise it to 11.2%. This tax is collected by the retailer and remitted to the state, an addition to the RRP for the final consumer price.

Also, read about the wholesale price.

Factors that Influence Your RRP Decision

Calculating RRP is not just about applying formulas; it is about making informed business decisions based on a range of factors that influence it.

1- Market Dynamics

Demand & Supply

Prices are mainly influenced by supply and demand, which means how much people want a product and how much of it is available. If many people want the product and there’s not much left, the price can go up. If few want it and there are lots available, the price tends to go down.

Competitor Pricing

Knowing what other businesses charge helps set your prices so they’re competitive but still profitable. Most US shoppers compare prices before buying—96% check other options, and 63% search on Google for better deals. This means you can’t ignore what competitors are charging.

2- Perceived value & brand positioning

Customer Perception

How much customers think a product is worth is very important. Price-based pricing sets the retail price (RRP) based on this perceived value, often resulting in higher prices for unique or valuable products.

Brand Image

Pricing also shows what a brand stands for. Premium brands usually set higher prices to look more luxurious, while value brands use medium prices, and budget brands set lower prices to attract cost-conscious shoppers. Studies show that people are willing to pay full price for items they see as high-quality, exclusive, or prestigious For luxury brands, perceived value makes customers less sensitive to price.

Consumers are very aware of prices and often compare them. However, they are also willing to pay more if they believe a product offers good value, quality, or a better experience. ‘Value’ isn’t just about the lowest price; it includes factors like quality, exclusivity, convenience, and brand trust. Businesses shouldn’t just lower prices to compete. Instead, they should focus on adding value through quality, service, and storytelling. This way, they can set higher prices while still appealing to customers who look for good value, not just the cheapest option.

3- Economic conditions

Inflation

Rising costs mean businesses may need to raise their retail prices to stay profitable. In the US, about 43% of consumers are mainly concerned with increasing prices. Despite this worry, people are still spending; some are spending less in certain areas while splurging in others.

Supply Chain Disruptions

Problems like tariffs or delays in shipping can raise costs significantly. For example, tariffs could increase farm production costs in the U.S. by up to 15%. These higher costs need to be included in the RRP to keep profits healthy.

4- Profit margin goals

Having a clear profit goal helps keep the business healthy. The goal should cover all costs and still leave enough for a profit.

5- Industry Benchmarks

Knowing the average profit margins in an industry helps set realistic retail prices. For example, retail and online stores usually have profit margins of 8-12%, while tech and software companies can have margins of 20-40%. These figures provide a guideline for setting competitive and profitable retail prices.

RRP and US Antitrust Laws

Why Manufacturers cannot legally mandate retail prices in the US

The main goal of US antitrust law is to keep markets competitive. Businesses agreeing to fix prices are usually illegal. The Sherman Antitrust Act of 1890 is a key law that bans any contract or agreement that restricts trade. This includes cases where manufacturers make retailers sell products at a set price. Although Recommended Retail Price (RRP) is just a suggestion, any agreement that sets a minimum resale price, called Resale Price Maintenance (RPM), is generally viewed with suspicion under these laws.

Price Fixing

Horizontal Price Fixing

When two or more competitors at the same level in the market, like retailers, agree to set their prices together or agree not to compete in certain areas or products. This is illegal under antitrust laws, regardless of the reasons or the impact on competition.

Vertical Price Fixing (Resale Price Maintenance – RPM)

This involves agreements between businesses at different levels of the supply chain, like manufacturers and retailers, that agree on set prices. In the past, such agreements were always considered illegal. But a 2007 Supreme Court case changed that rule, introducing a “rule of reason” approach. Now, courts evaluate whether these agreements help or harm competition before deciding if they are legal.

The federal “rule of reason” standard is used in antitrust cases, but in some states like California, Maryland, and New York, RPM agreements are automatically considered illegal under state laws.

The shift from “per se” illegality to a “rule of reason” for vertical price agreements (RPM) in federal law, along with different state laws, makes the legal environment complex and risky for manufacturers trying to influence retail prices. This patchwork of laws means that something permitted federally might still be illegal in some states. Due to this legal uncertainty, manufacturers often prefer unilateral policies like Minimum Advertised Price (MAP), which controls how products are advertised rather than the actual selling price, to better protect their brand. The main goal is to avoid any suggestion of collusion between manufacturers and retailers. For businesses, especially those operating in multiple states, it’s important to consult legal experts when developing pricing strategies that involve manufacturer recommendations or controls. Mistakes can result in hefty fines or even jail time. Overall, setting a recommended retail price (RRP) is not just a business decision but a complex legal matter.

Pricing Strategies and Formulas

1- Value-Based Pricing

When you set prices based on customer-perceived value rather than costs:

Formula:

Price = Customer’s Perceived Value – Buffer

The truth is, most customers don’t really know what a product should cost. Instead, they rely a lot on how valuable they think it is. This perceived value is often more powerful than the actual, objective value

2- Competitive Pricing

When you set prices based on competitor pricing:

Formula: Price = Competitor’s Price ± Strategic Difference

This method is mostly used by brands when they are dealing in highly competitive markets with similar products.

For example: If competitors price at $50, you might price at $48 to undercut or $52 for premium positioning.

3- Dynamic Pricing

Prices that change based on market conditions:

Formula:

Price = Base Price × Demand Factor × Supply Factor × Time Factor

This is the method used by brands during high-demand fluctuations, particularly when dealing with seasonal products.

For example: Hotel rooms, airline tickets, ride-sharing services etc

Psychological Pricing Strategies

4- Charm Pricing

This popular trick involves setting prices just below a round number (like $9.99 instead of $10, or $19.95 instead of $20). Because our brains are wired to focus on the first digit, the price feels much cheaper than it actually is.

5- Decoy Effect

In this method, in addition to setting a price, you add a third, less attractive option, and you can cleverly guide customers toward the product you want them to buy. For example, a medium popcorn that’s only a little cheaper than a large one might make the large seem like a much better deal.

6- Loss Aversion

This mental bias means that the bad feeling of losing money (the “pain of paying”) is felt more strongly than the good feeling of gaining the same amount. Strategies that make this “pain” feel smaller can be very effective.

For example, losing $10 on a product can cause more pain than gaining the same $10.

7- Anchor Pricing

Setting a high reference price to make other prices seem reasonable.

Anchor Price = Target Price × 1.5 to 2.0

The first price a customer sees for a product or something similar sets a mental reference point, or “anchor.” All other prices are then judged against this anchor. This can make a discounted price seem much more appealing when compared to a higher starting price.

For example: When you show a $200 watch as “Originally $400, Now $200”.

8- Penetration Pricing

A method where brands use a low initial price to quickly gain market share.

Formula: Price = Cost + Minimal Profit Margin

Brands use this method as a new market entry, building a customer base.

For example, setting the price at $6.05 when the cost is $6 to undercut competitors at $15.

9- Price Skimming

High initial price, gradually lowered over time.

When launched, the business sets a high price that is gradually reduced by 10-30% over time. Brands use this method with products that have limited market competition. Like when a new iPhone is launched. The price is initially set higher, such as $999, which is reduced to $799 after 6 months, and so on.

10- Premium Pricing

Most high-end brands use this method where they set prices at a very high number to signal quality and exclusivity. Where the premium markup ranges from 50-300% depending on the industry.

Price = Cost × (1 + Premium Markup)

This method is used when selling luxury goods, status symbols, high-quality offerings like designer handbags, luxury cars, and premium brands.

11- Bundle Pricing

When you sold pultiple products together at a discount price.

Formula: Bundle Price = (Product A + Product B + Product C) × (1 – Discount %)

For example, if you serve combos like Burger + Fries + Drink = $15 (vs. $18 individually).

- If margins > 50%: 10-20% discount

- If margins < 50%: 5-10% discount

12- High-Low Pricing

Alternating between high prices and promotional discounts.

Formula:

- High Price = Standard Price × 1.2-1.5

- Low Price = Cost + Minimal Margin

Most departmental stores use this pricing method to create urgency and to drivr traffic.

13- Captive Product Pricing

In this method, a brand sells the core product at a low price while charging high margins on accessories. For example, printers are sold at the original price, while ink cartridges have a 300% markup.

Formula:

- Core Product Price = Cost or Below Cost

- Captive Product Price = Cost × High Margin (100-500%)

End note

If you want your business to grow sustainably, first learn to set a price that is both profitable and market-competitive, based on your industry and product.

Smart pricing isn’t about being the cheapest. It’s about showing customers the value of what you offer. By regularly analyzing prices, keeping an eye on the market, and adjusting your strategies, your business can set the right retail price. This helps you stand out, attract more customers, and succeed in the competitive US retail market.